The U.S. dollar was supported by comments from the Federal Reserve boss on the need to proceed with rate climbs, while the euro licked the injuries from political vulnerability following the German decision at end of the week.

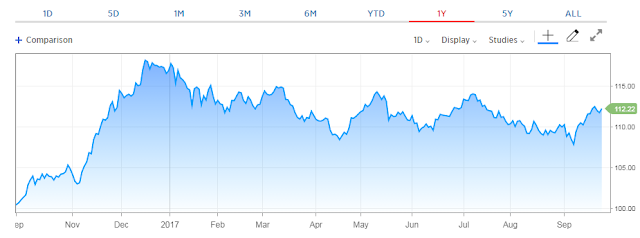

The dollar's record against a wicker bin of six noteworthy monetary forms remained at 93.07 in early Wednesday exchange after it achieved a high of 93.286 the earlier day, its most abnormal amount in very nearly a month.

Encouraged Chair Janet Yellen said on Tuesday that the Federal Reserve needs to proceed with progressive rate climbs notwithstanding expansive vulnerability about the way of swelling.

It would be "would be indiscreet to keep financial arrangement on keep until the point when swelling is down to 2 percent," she said.

"Her remarks recommend that most recent (delicate) swelling readings don't have a major bearing on the Fed's fiscal strategy. The Fed's concentration is not to defer rate climbs excessively to stay away from a circumstance where it needs to bring rates quickly up later on," said Yukio Ishizuki, senior strategist at Daiwa Securities.

U.S. loan fee prospects cost plunged further to cost in around 70 percent possibility of a rated climb by December contrasted with close to 60 percent on Monday.

Against the yen the dollar remained at 112.27 yen, ricocheting over from Tuesday's low of 111.50.

The euro slipped to a five-week low of $1.17575 on Tuesday and last remained at $1.1790. The euro debilitated against different monetary forms, hitting a 10-week low of 0.87545 British pound and two-week low of 1.14075 Swiss francs.

The basic money had mobilized more than 10 percent so far this year on as stresses over the ascent of rebellious political powers in Europe blurred while desires ascended for decreasing the European Central Bank's boost.

Yet, the ascent of a far-right gathering and the decrease of conventional gatherings in Sunday's German decision has left Chancellor Angela Merkel attempting to frame a coalition government, scratching financial specialist supposition.

Somewhere else, the Australian dollar slipped a smidgen to $0.7874 in the wake of having dropped to the six-week low of $0.7860 on Tuesday.

The Aussie was undermined by a fall this month in the cost of iron mineral, its primary fare item.

The greatest concentration for the market for Wednesday is the declaration of a duty design by the U.S. organization and Republicans in Congress.

The arrangement has been produced more than a while by six White House and congressional Republicans working away from plain view. President Donald Trump told U.S. officials on Tuesday he needs bipartisan participation on assessing change.

The dollar's record against a wicker bin of six noteworthy monetary forms remained at 93.07 in early Wednesday exchange after it achieved a high of 93.286 the earlier day, its most abnormal amount in very nearly a month.

Encouraged Chair Janet Yellen said on Tuesday that the Federal Reserve needs to proceed with progressive rate climbs notwithstanding expansive vulnerability about the way of swelling.

It would be "would be indiscreet to keep financial arrangement on keep until the point when swelling is down to 2 percent," she said.

"Her remarks recommend that most recent (delicate) swelling readings don't have a major bearing on the Fed's fiscal strategy. The Fed's concentration is not to defer rate climbs excessively to stay away from a circumstance where it needs to bring rates quickly up later on," said Yukio Ishizuki, senior strategist at Daiwa Securities.

U.S. loan fee prospects cost plunged further to cost in around 70 percent possibility of a rated climb by December contrasted with close to 60 percent on Monday.

Against the yen the dollar remained at 112.27 yen, ricocheting over from Tuesday's low of 111.50.

The euro slipped to a five-week low of $1.17575 on Tuesday and last remained at $1.1790. The euro debilitated against different monetary forms, hitting a 10-week low of 0.87545 British pound and two-week low of 1.14075 Swiss francs.

The basic money had mobilized more than 10 percent so far this year on as stresses over the ascent of rebellious political powers in Europe blurred while desires ascended for decreasing the European Central Bank's boost.

Yet, the ascent of a far-right gathering and the decrease of conventional gatherings in Sunday's German decision has left Chancellor Angela Merkel attempting to frame a coalition government, scratching financial specialist supposition.

Somewhere else, the Australian dollar slipped a smidgen to $0.7874 in the wake of having dropped to the six-week low of $0.7860 on Tuesday.

The Aussie was undermined by a fall this month in the cost of iron mineral, its primary fare item.

The greatest concentration for the market for Wednesday is the declaration of a duty design by the U.S. organization and Republicans in Congress.

The arrangement has been produced more than a while by six White House and congressional Republicans working away from plain view. President Donald Trump told U.S. officials on Tuesday he needs bipartisan participation on assessing change.

Related Security:-

For more updates visit - Forex Advisory Singapore, Forex Trading Picks, Forex Trading Tips, Forex Tips Provider Singapore, Forex Trading Tips and Strategies

No comments:

Post a Comment