The dollar crept higher against a wicker bin of real monetary forms on Friday, having pulled once again from one-month highs set for the current week as speculators contemplated the Trump organization's expense design and the standpoint for Federal Reserve approach.

The dollar list, which tracks the greenback against a wicker bin of six noteworthy monetary forms, rose 0.1 percent to 93.155, grieving beneath Thursday's pinnacle of 93.666, its most abnormal amount since Aug. 18.

For the week, the dollar record has increased 1.1 percent, putting it on track for its greatest week after week pickup since December.

The dollar climbed for this present week on recharged seeks after U.S. charge changes and in addition remarks from Federal Reserve Chair Janet Yellen that focused on the requirement for slow financing cost climbs.

Merchants are likely taking benefits in the wake of the dollar's rally, said Stephen Innes, head of exchanging Asia-Pacific for Oanda in Singapore.

"It's additionally the acknowledgement that we've been down this duty change street sometime recently, and I don't believe it will be simple... There will be a great deal of forward and backward, a considerable measure of quarrelling," Innes included.

U.S. President Donald Trump proposed on Wednesday the greatest U.S. assess update in three decades, calling for tax reductions for generally Americans.

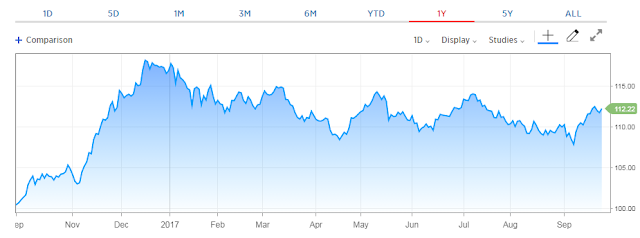

Against the yen, the dollar edged up 0.2 percent to 112.57 yen. On Wednesday, the dollar had achieved a 2-1/2 month high of 113.26 yen.

Later on Friday, financial specialists will turn their concentration to U.S. monetary information including the individual utilization uses (PCE) value record for August.

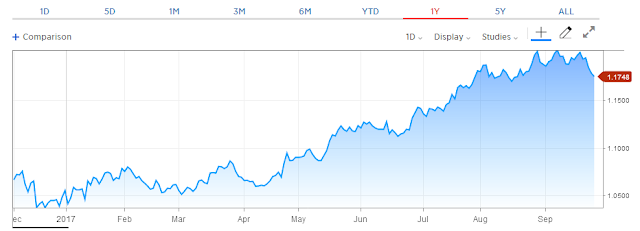

The euro held consistent at $1.1786, having pulled up from Wednesday's trough of $1.1717, the normal money's most reduced level in over a month.

The basic money has aroused 12 percent against the dollar so far this year as stresses over the ascent of insurrectionary political powers in Europe blurred while desires ascended for decreasing the European Central Bank's jolt.

The euro, be that as it may, has been overloaded for the current week after the aftereffects of decisions in Germany on Sunday. Chancellor Angela Merkel won a fourth term in office however should construct an uneasy coalition to shape an administration.

Sterling facilitated 0.1 percent to $1.3425. On Thursday, it had increased 0.4 percent, after Britain's Brexit secretary said: "extensive advance" had been made in talks and the EU's central mediator lauded "another dynamic" from the PM.

Related Securities:-

For more updates visit - Forex Advisory Singapore, Forex Trading Picks, Forex Trading Tips, Forex Tips Provider Singapore, Forex Trading Tips and Strategies