The dollar exchanged close to a one-month high against a wicker bin of monetary standards on Thursday, supported by trusts that U.S. President Donald Trump's organization might gain ground on financial changes.

The dollar's record against a wicker bin of six noteworthy monetary standards last exchanged at 93.414. The dollar list achieved a high of 93.607 on Wednesday, its most grounded level since Aug. 23 and has increased around 1.3 percent so far this week.

U.S. President Donald Trump on Wednesday proposed the greatest U.S. assess update in three decades, offering to cut charges for most Americans yet provoking feedback that the arrangement supports the rich and organizations and could add trillions of dollars to the deficiency.

The disclosing of the assessment design, combined with peppy information on U.S. strong merchandise orders, helped give an additional lift to the greenback, which has profited from revived desires that the Federal Reserve will raise loan fees again by year-end.

While the dollar has balanced out, helped by an ascent in U.S. security yields, the greenback's ricochet is still a long way from being a "solid bounce back", said Heng Koon How, head of business sectors system for United Overseas Bank in Singapore.

The U.S. 10-year Treasury yield rose to as high as 2.316 percent on Wednesday, it's most noteworthy since Aug. 1.

Against the yen, the dollar remained at 112.82 yen, having ascended to as high as 113.26 yen on Wednesday, its most grounded level in over two months.

All things considered, it might be untimely to see the greenback's skip as an arrival to a pattern of dollar quality, said Teppei Ino, an expert for Bank of Tokyo-Mitsubishi UFJ in Singapore.

The close term concentrate will be on U.S. information, for example, the individual utilization uses (PCE) value list for August due on Friday, and in addition U.S. occupations information due one week from now, Ino stated, including that the dollar-positive disposition could change if such pointers come in feeble.

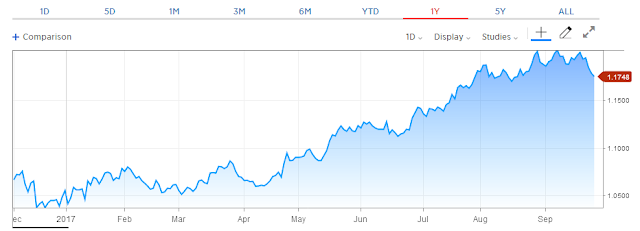

The euro held enduring at $1.1748, having tumbled to as low as $1.1717 on Wednesday, its most reduced level in over a month.

Financial specialist assessment toward the euro has been marked by Sunday's German decision, where Chancellor Angela Merkel is attempting to shape a coalition government.

Somewhere else, New Zealand's national rely upon Thursday kept loan fees unaltered at record lows of 1.75 percent and immovably adhered to its nonpartisan position, against a set of political vulnerability after an uncertain national race.

The New Zealand dollar last remained at $0.7228. It slipped quickly to levels beneath $0.7200 after the national bank articulation, yet later recovered its balance.

Related Securities:-

For more updates visit - Forex Advisory Singapore, Forex Trading Picks, Forex Trading Tips, Forex Tips Provider Singapore, Forex Trading Tips and Strategies

No comments:

Post a Comment