The dollar grieved almost a nine-month low against a crate of monetary forms on Friday, impeded by developing desires of more hawkish money related strategies in Europe and Canada and questions about another U.S. loan cost increment this year.

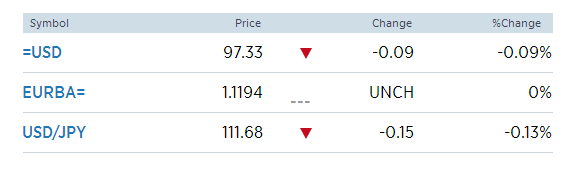

The dollar list, which measures the greenback against a wicker container of six noteworthy monetary forms, last remained at 95.598. That was close to a low of around 95.53 touched for the current week, its most reduced level since early October 2016.

The euro facilitated 0.1 percent to $1.1430, stepping back marginally from a pinnacle of $1.1445 set for this present week, the normal money's most grounded level in right around 14 months.

The euro has risen quickly following Tuesday's discourse by European Central Bank President Mario Draghi that persuaded markets the ECB was get ready to begin lessening its forceful financial boost not long from now.

What's more, remarks from Bank of England Governor Mark Carney and two top Bank of Canada policymakers on Wednesday increase desires for loan cost increments from those national banks

"Clearly there's a move in progress. It truly appears that there's some planned exertion going ahead over here among the G10 national banks," said Stephen Innes, head of exchanging Asia-Pacific for OANDA in Singapore, alluding to the arrangement of hawkish-sounding remarks on money related approach.

"I think what we're seeing right now, it's a truly enticing business sector. So this could be more about the way that no one needs to pass up a great opportunity for the gathering," Innes stated, including that the euro could add to its increases in the close term.

For the April-June quarter, the euro was on track for a pick up of around 7.3 percent, its best quarterly execution since the July-September quarter of 2010.

Sterling edged up 0.1 percent to $1.3016, having increased 2.3 percent so far this week.

Market members' waiting questions that the Fed would have the capacity to raise financing costs again this year, have weighed on the U.S. dollar.

Against the yen, the dollar facilitated 0.1 percent on the day to 112.01 yen.

Related Securities

For more updates you can visit - daily forex signals, forex trading tips, forex picks, forex Signals, forex tips provider