The dollar ascended on Tuesday to its most elevated amount against the yen in about five weeks in front of remarks from Federal Reserve Chair Janet Yellen that are relied upon to underline her sure perspective of the U.S. monetary viewpoint.

She is planned to partake in a discourse later on Tuesday at London's Royal Academy. A positive view regardless of a current group of feeble U.S. financial information would bolster the Fed's estimate for another ascent in approach rates this year.

"Speculative stock investments are now offering yen this week, and positive remarks from Yellen could give them a reason to offer much more," said Kaneo Ogino, chief at outside trade examine firm Global-information Co in Tokyo.

The dollar rose to 112.075 yen before on Tuesday, its most abnormal amount since May 24. It was last at 111.88 yen, up marginally on the day.

U.S. information on Monday gave financial specialists motivation to be mindful about purchasing the dollar. New requests for key U.S.- made capital merchandise suddenly fell in May and shipments likewise declined, proposing lost force in the assembling segment part of the way through the second quarter.

"Indeed, even after the break of the 112 level, the dollar didn't demonstrate any solid upward force," said Masashi Murata, senior cash strategist at Brown Brothers Harriman in Tokyo.

After the powerless information raised worries about falling expansion and dull development, since quite a while ago dated U.S. Treasury security yields dropped to seven-month lows and the yield bend between five-year notes and 30-year securities limited to its flattest level since 2007.

U.S. 10-year Treasury yields were at 2.138 percent in Asian exchanging, minimal transformed from a U.S. close on Monday of 2.137 percent.

Sustained authorities have adhered to their hawkish scripts.

San Francisco Fed President John Williams said in Sydney on Monday that a lull in U.S. swelling was essentially because of irregular elements and ought not forestall additionally increments in loan costs.

Monetary conditions have extricated in the previous year in spite of the Fed raising loan costs three times since December, which is another motivation to keep fixing, New York Fed President William Dudley said in comments distributed on Monday

The euro rose 0.1 percent to $1.1188, climbing from its overnight low of $1.1172 come to after tentative remarks from European Central Bank President Mario Draghi, which stood out forcefully from those of Fed authorities.

In a town-corridor with college understudies in Lisbon, Draghi said super low loan fees make occupations, cultivate development and advantage borrowers. He dismisses calls to leave super simple fiscal approach rapidly, contending untimely fixing would prompt a crisp retreat and greater imbalance.

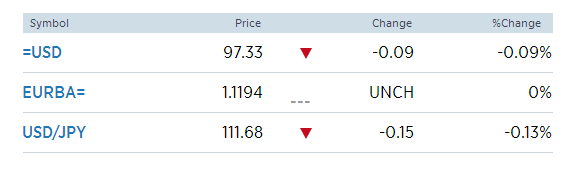

The dollar file, which tracks the greenback against a wicker container of six noteworthy adversaries, crawled 0.1 percent bring down on the day to 97.367.

Related Securities

For more updates you can visit - daily forex signals, forex trading tips, forex picks, forex Signals, forex tips provider

No comments:

Post a Comment