The dollar broadened its humble skip from 15-month lows on Wednesday, profiting from a respite in the offering of the battered money as financial specialists start situating for key occasions this week, prominently Friday's U.S.employment report.

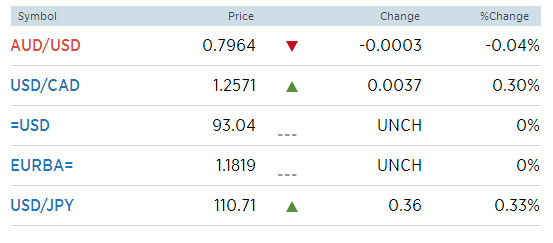

The dollar file against a bushel of real monetary standards shook off a decrease in Treasury yields and was a shade higher at 93.090 subsequent to ricocheting from 92.777, it's most minimal since May 2016.

The euro was unaltered at $1.1806 in the wake of being bumped far from a 2-1/2-year pinnacle of $1.1846 set the earlier day.

The greenback has been burdened by political turmoil holding Washington and to a great extent sub-par U.S. monetary information, especially drowsy swelling, which is adding to vulnerability about the pace of future Federal Reserve strategy fixing.

"The dollar has effectively debilitated fundamentally, particularly against its European partner, achieving a point where a few members started purchasing back the money in front of Friday's U.S. work information," said Shin Kadota, senior strategist at Barclays in Tokyo.

"Be that as it may, these are simple position modifications before the U.S. employments information and the bearish pattern for the dollar still stays in place," Kadota included.

The euro has increased around 12 percent against the dollar so far this year.

Notwithstanding the political dangers and money related arrangement instability that has tormented its U.S. peer, the regular cash has drawn help from desires that the European Central Bank would, in the long run, start eliminating its simple arrangement.

The U.S. cash was 0.15 percent higher at 110.535 yen, pulling far from a close to the seven-week low of 109.920 touched overnight.

"The dollar is being bolstered against the yen with U.S. stocks proceeding to perform firmly, regardless of the potential dangers they are confronted with," said Ayako Sera, a senior market financial expert at Sumitomo Mitsui Trust.

The Dow piled on a fifth straight record high on Tuesday, even as Wall Street loses certainty that President Donald Trump and a Republican-controlled Congress will have the capacity to push through tax reductions and expanded spending on framework this year.

Sera at Sumitomo Mitsui Trust likewise said that the market is probably going to take in walk a bureau reshuffle anticipated Thursday by Japanese Prime Minister Shinzo Abe, who plans to resuscitate his hailing appraisals.

"Market members obviously will be observing how the Bureau reshuffle turns out. Be that as it may, barely any, anticipate that the reshuffle will affect the market," Sera said.

For the potential effect on the dollar, the market anticipated the U.S. ADP occupations report and remarks by San Francisco Fed President John Williams and Cleveland Fed boss Loretta Mester due later in the session.

The greenback, then, figured out how to bob back against dollar alliance monetary forms, for example, the New Zealand and Canadian dollars.

The New Zealand dollar dropped to a one-week low of $0.7416 and was last down 0.5 percent at $0.7427 following dull information.

The quantity of occupations made in New Zealand fell out of the blue and wage swelling staying lukewarm in the second quarter, adding weight to the possibility of the national bank keeping rates on hold at record lows for a considerable length of time.

The Canadian dollar battled subsequent to being hit by a slide in raw petroleum costs.

The loonie stretched out its overnight drop to exchange at C$1.2570 per dollar, pulled advance far from a 25-month high of C$1.2414 achieved a week ago.

The Australian dollar, another item connected money, was down 0.2 percent at $0.7953 following its climb the earlier day to $0.8066, it's most grounded since May 2015.

Related Securities:-

For more updates, you can visit- daily forex signals, forex trading tips, forex picks, Forex Signals, Forex tips provider.

No comments:

Post a Comment