The dollar slipped against the yen on Wednesday on worries about rising strains between the United States and North Korea while the Canadian dollar held firm after the country's national bank boss sponsored a financing cost increment.

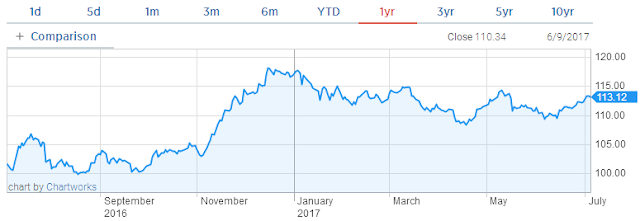

The dollar shed 0.3 percent in early exchange to get 112.95 yen, slipping further from Monday's 1-1/2-month high of 113.48.

The yen has a tendency to be purchased back now and again of elevated worldwide instability on account of desires Japanese speculators may repatriate their remote venture, in spite of the nation's vicinity to North Korea.

Pyongyang said on Wednesday it had directed a trial of a recently created intercontinental ballistic rocket that can convey an expansive and overwhelming atomic warhead, setting off a call by Washington for worldwide activity to consider the disconnected country responsible for its quest for atomic weapons.

The Pentagon denounced the rocket test and said it was set up to guard the United States and its partners against the developing risk from North Korea.

The Canadian dollar additionally held firm, exchanging at C$1.2934 per dollar in the wake of having hit a 10-month high of C$1.2912 to the dollar on Tuesday.

Bank of Canada Governor Stephen Poloz told a German daily paper that Canada's expansion ought to be well into an uptrend by the principal half of 2018, including that arrangement standardization must start before value development hits its objective.

His remarks provoked markets to cost in a more than 50 percent possibility of a rate climb at the national bank's next meeting on July 12, a sensational turn from under two weeks back when scarcely anybody had wagered on a fixing.

The euro was likewise upheld by desires the European Central Bank is edging towards twisting back its jolt following hawkish remarks from its President Mario Draghi a week ago.

In spite of the fact that the regular cash slipped early this week in the wake of arousing 2.1 percent a week ago, it has settled around $1.1359.

"In the event that we have more remarks from ECB authorities plainly inferring decreasing of its jolt, we could see promote upside in the euro," said Bart Wakabayashi, Tokyo Branch Manager of State Street.

A week ago's top of $1.1445, its most elevated amount in finished a year, is viewed as its prompt target. An unmistakable break of the $1.15-16 region would flag a noteworthy takeoff from its exchanging range since mid 2015.

The Australian dollar licked injuries at $0.7612 after the country's national bank adhered to an impartial position on the economy and loan costs on Tuesday, disillusioning numerous brokers who had expected a more hawkish tone.

Related Securities

For more updates you can visit - daily forex signals, forex trading tips, forex picks, forex Signals, forex tips provider

No comments:

Post a Comment